COVID-19 AND FOOD: THE RISE OF THE NEXT FINANCIAL REVOLUTION?

Global consumer expenditure growth is forecast to fall by 4.3% in real terms year-on-year in 2020...While consumers cut back their spending, food & non-alcoholic beverages will be the only category to record positive spending growth in 2020, since lockdowns and self-isolations prompted them to stockpile.

Data and numbers never lie, and the aforementioned cold and cynical analysis of Euromonitor undoubtedly leads to some reflection. Taking a look at the graph, it stands out that F&B will be the only sector growing this year, registering a +2%. Obviously, these socio-economic changes will have an impact, even at a financial level. It’s no secret that the generalist PE funds, as VCs, are watching with an increasingly greater interest in deals in food and foodtech.

Are we watching the rise of the next financial revolution? To reply to these questions, we gathered some experts of the sector as witnesses.

MADE IN ITALY ABOVE ALL

538 billion in revenue in 2019 (the 25% of Italian GDP), 3,8 millions people employed and the absolute leadership on italian industrial landscape. Combining these numbers

with Euromonitor report data, it’s clear that italian agrifood aroused the

interest of the PE behemoths, even at an international level.

But there’s more, as explained by Massimiliano Bruno (Max) , Principal at international advisory firm goetzpartners “The rise of Slow Food drove the Italian food & beverage to be considered not just as a simple set of products but as a true food experience, improving its appeal beyond Italy’s border.”

Italian food has definitely been acquiring a “premium” dimension, whetting the appetite not just of consumers, but even of investors “Expanding a brand abroad needs, first of all, to adapt the products to local tastes, then obviously a skilled management and an effective strategy, with a development plan including insights driven by market research in order to scale up the business. All that might sound familiar for a big corporation, maybe a little less for Italian SMEs. And that’s where the funds come into play”.

In this kind of transition, as confirmed by Max, an important role has been played by historical Italian brands who first paved the way and, more recently, by companies such as Eataly and its visionary founder Oscar Farinetti, that, by leveraging on their international distribution platforms which is otherwise not accessible to small brands, further gave its contribution in fighting the Italian sounding food, valued at 100 billion euros as per Coldiretti estimates.

But what do PE funds look for? Which features must food companies have to be attractive to the international finance behemoths? “Definitively I would say brand history, storytelling, quality, traceability, international certifications, but also a willingness or the potential to produce private label, which is constantly increasing its penetration in the mass retail channel. Regarding the sectors, the actual focus is on the bakery, both fresh and frozen, healthy and vegan. Furthermore, on the VC side, there’s a growing interest in innovative products and business models such as alternative proteins and dark kitchens”.

Max makes an interesting reflection on the megatrends. “ For an effective expansion strategy, Italian products should not be associated exclusively with Made In Italy, which is still recognised as a high-value brand, but should also consider riding the waves of mega-trends such as vegan, healthy, and flexitarian”.

Switching to funds, what are the motivations driving them to invest

in the food sector? “We recently interviewed some generalist PE

funds investing in mid-market and all of them substantially confirmed

they are watching food with increasing interest because it’s an

extremely resilient sector with little trouble during these times,

except

for businesses largely involved in foodservice which were highly impacted by COVID-19””.

This increased competition among funds is even driving a rise in deal values: “Actually on a deal, we might even have 4 or 5 funds and that drive to increase the EBITDA multiple from x7 to x8 to x10 or even x12 for the deals in beverages or historical companies/brands. The average for Italian food nowadays is around x10”.

So in the future, we will see an increase in PE deals in the sector, lots of add-ons and a slowdown in foodservice. But there’s more. “There is a growing interest for foodtech, not exclusively by VCs but even by PE, as technology could be an incredible boost to the business”. Definitively, a Made In Italy is adapting to the new needs of modern consumers, as already done for example by Nestlè.

THE REVERSE OF THE MEDAL

But not all that glitters is gold and COVID-19 has obviously brought some troubles to Italian food companies, especially the little ones, as explained by Livio Cademartori.

Livio Cadermartori began his professional career within his

family's business in the dairy sector, Cademartori, sold to Le

Groupe Bel in 1999, then to fund BC Partners and actually in

Lactalits portfolio. He is actually food industry advisor by

Translink Corporate Finance.

“The lockdown - says Livio - found lots of small agrifood companies unprepared. They experienced a rise in costs and a drop in revenues, with an obvious impact on EBITDA. This might drive the companies to increase their debt or sell equity stake, but obviously in unfavourable conditions”.

So due to COVID-19, Italy could become up for grabs by PE and even big food corporations. “Considering the drop in EBITDA and meanwhile the lack of industrial centres in some sectors, such as dairy and confectionery, some Italian agrifood companies are highly exposed to a kind of “wild shopping” by funds and food behemoths”.

Regarding the lack of management and international exposure discussed with Max, Livio gives his interesting reading of this: “An Italian premium brand, even without skilled management, is still attractive abroad. The lack of management could undoubtedly represent a challenge for the fund but meanwhile put a lid on the negotiations, as it could need a lot of work. An Italian food SME could be interested in starting the internationalization process by itself, to be more appetising for a future buyer”.

Finally, Livio agrees

that modifying the formula to adapt the product to local taste is

needed “but it’s not possible of course for products such as

cheeses and PDO/PGI, because they are subject to Italian laws and/or

production regulations”.

FOODTECH RULES

Talking about the investments in AgrifoodTech, during the first webinar of my series “AgriFoodTech in Italia”, Giancarlo Addario, Principal at Five Seasons Ventures, said “Even before Covid the generalist venture capitalists took a remarkable interest in foodtech.”

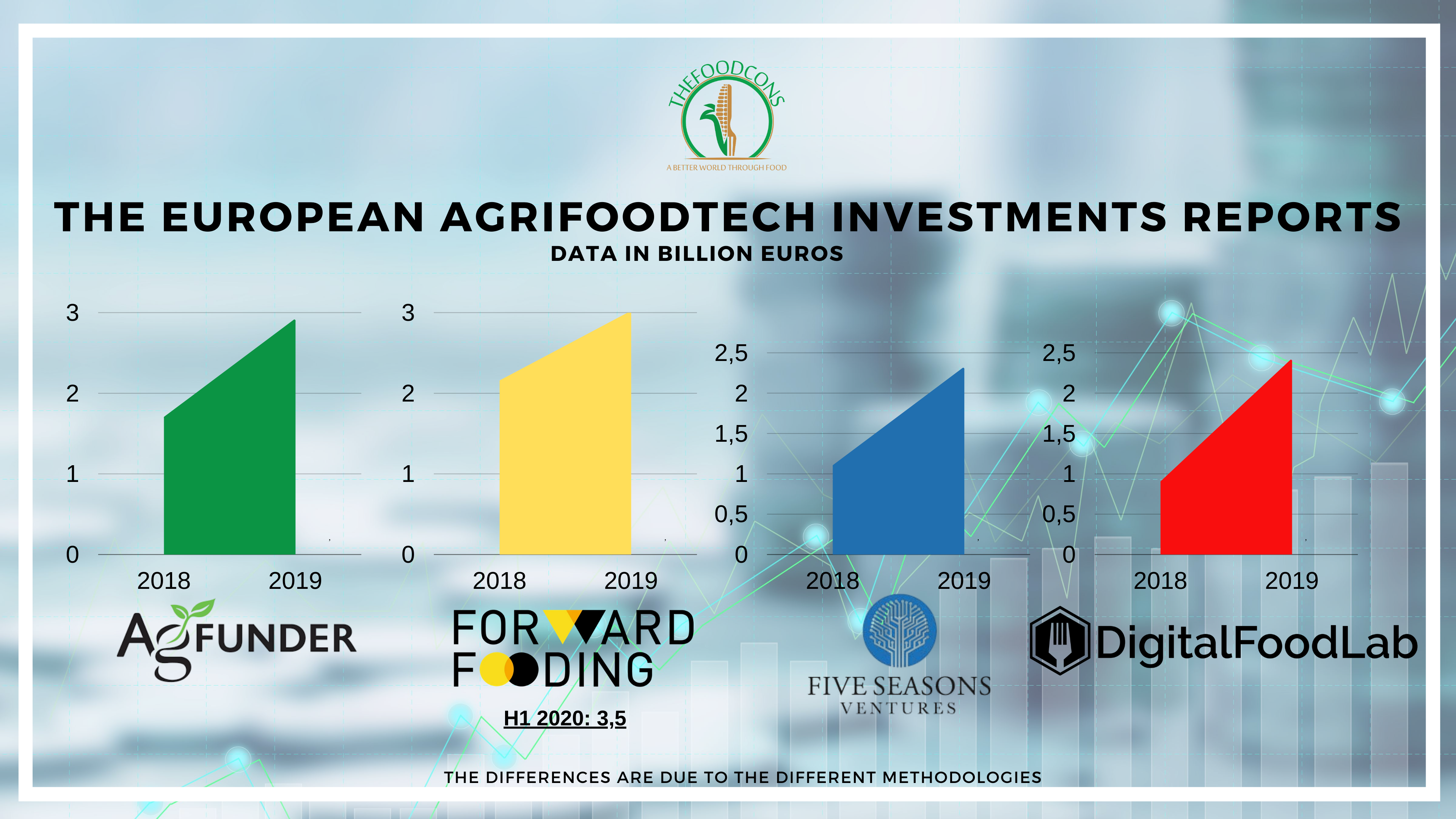

This is confirmed by the numbers. As indicated in the graph, all investment reports, albeit with different figures, show a huge increase in investments between 2018 and 2019.

Even in this unfortunate 2020, despite the pandemic, we watched the closing of some interesting rounds. Some examples? 250 milions $ raised by Apeel Science, $200m by Oatly, $300m by Indigo's. Just to name three.

Among the investors of some of these rounds were both specialized and generalist VCs, as further confirmation of Giancarlo’s quote.

To know more about this kind of transition in foodtech investments, we reached Alessandro Santo, Kaufmann Fellows, with a reliable track-record in vc, actually Director at Last Mile Venture, a family investment holding.

Alessandro, notwithstanding the rounds closed by a specialist VC, are you watching a growing interest in foodtech by generalist VCs? "Yes, undoubtedly. As much as it is a

clichè, technology is impacting any industry and money

follows quickly. Food was a niche segment but now we see

that the growth of specialist players is followed by

generalists. In the food delivery segment companies such

as Deliveroo, Delivery Hero and more have attracted large

growth investors, but you can see the recent Vengrove

investment in Karma Kitchen or Softbank activity in the

segment to see how this trend is going "global and broad".

I would also point out the growing interest of corporates

in a segment which, as I just said, is becoming less

technical".

Besides the alternative proteins, a sector in rapid growth ($930M invested in Q1 2020 vs. $824M in all of 2019), which other sectors are investors interested in? "Well

pretty much any segment of the value chain is being

touched. You see a lot of activities in the Ag Tech

business with an expansion of robotics; packaging is also

in focus with the ever growing focus on sustainability

(and recently the Italian Feletti announced a more

sustainable packaging) and although the covid lockdown has

had a massive impact on the restaurant business, there is

a flurry of companies trying to digitalise how restaurant

owners shop".

Talking about the higher rounds (from Series C and above) do you think the better “firepower” of a generalist VC combined with the better expertise of a specialist VC could be a winning combo? "It

is! VC deals are always syndicated and it's fairly common

to see a specialist (say SOSV) betting early and a

generalist (say Softbank) coming

in for growth. The role of corporates is still a question

mark as they're trying a foray in the segment, have the

resources to go early but sometimes are slow to act and

they end up buying companies in late M&A when they

could have invested early".

So is it time for a kind of food financial revolution? Definitively yes.